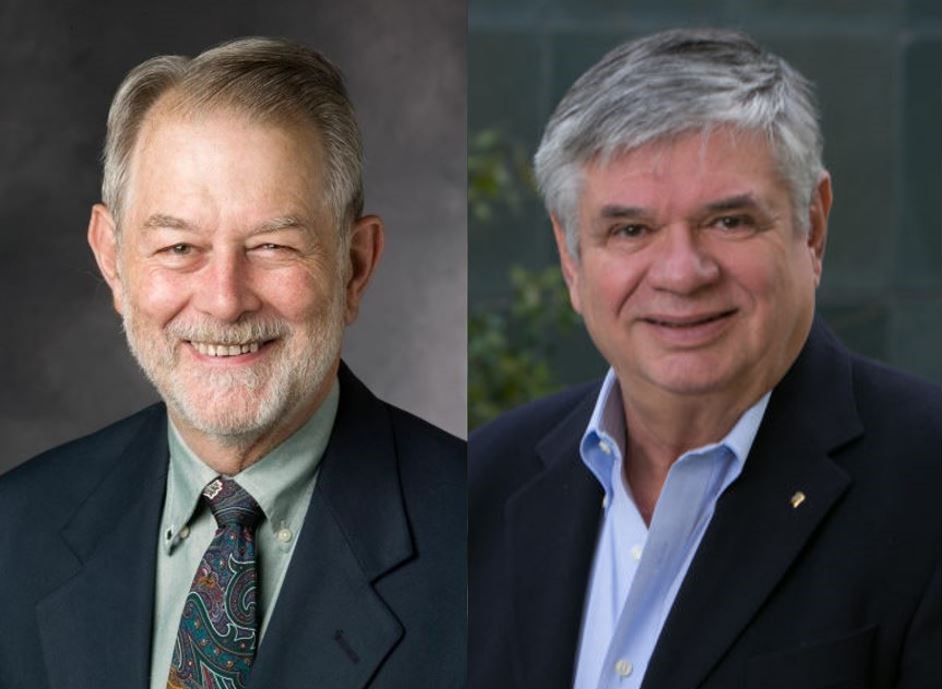

Prof. Shmuel Oren Reflects on his Collaboration with Nobel Laureate Prof. Robert Wilson

On October 12, 2020, Robert B. Wilson was co-awarded the 2020 Nobel Prize in Economic Sciences along with his long-time collaborator Paul Milgrom “for improvements to auction theory and inventions of new auction formats.”

Robert Wilson, a Professor Emeritus at Stanford’s Graduate School of Business, worked on many research areas throughout his career. These included economic theory and market design and pricing, where Berkeley IEOR Professor Shmuel Oren was one of Wilson’s closest collaborators. In a recent conversation, Professor Oren looked back on his work with Professor Wilson, and highlighted its relevance to today’s energy markets and other OR fields.

Professor Wilson’s foundational work on iterative combinatorial auctions in the early 70s was groundbreaking. Subsequent work by Paul Milgrom and their joint development of combinatorial auctions shaped mechanisms from government auctions of radio spectra to shopping on eBay. However, Professor Oren claims, “in the 70s, people didn’t even think any of this belonged to operations research.” He, along with Professor Wilson, would soon change the status quo.

Oren first started working with Wilson in 1979, when he was a researcher at Xerox and Wilson was hired as a consultant to help launch the firm into the broadband communications market by creating a network of Xerox’s new fax machines. Oren explains that this network was exposed to the concept of “network externalities” – the value of fax machines depended on the number of fax machines already in use. To build this network and price the usage of services where more users means more value, they used Wilson’s work on theory for pricing. Together, they developed the concept of critical mass – a pricing strategy that would take the network to a point where people would be willing to pay for it.

Through this interaction, Oren was given his first introduction to non-linear pricing by Wilson. As their collaboration furthered in the future, their initial research papers were based on non-linear pricing applied to the field of telecommunications. They then explored ideas of product differentiation, where an array of products would be differentiated by quality and would be priced relative to each other to maximize sales and usage. These ideas, Oren explains, are derivatives of auctions with the original theory extended to a broader scope.

Oren left Xerox in the 80s and undertook a professor appointment at Stanford. There, along with Hung-po Chao from the Electric Power Research Institute and Wilson, Oren realized that the electricity market is a good application of product differentiation. The researchers developed strategies for markets to allow customers to respond to peak and off-peak electricity supply. Instead of treating electricity as a homogeneous commodity, they would treat it as a qualitatively differentiated service – customers pay less if they are willing to tolerate less reliability. Instead of randomized or rotating curtailments, such a service would ensure continuous supply for most users. At the time, however, the technology for implementing this idea was lacking. Now, with technology in the form of energy storage solutions having caught up and a recognizable uptick in research funding, their idea has finally reached maturity.

For the past 35 years, through ideas like this, Oren and Wilson have worked to design deregulated energy markets using mechanism design theory that leverages Wilson’s Nobel Prize winning work. They have developed rules for contracts that work as implicit auctions and emulate results from actual auctions, which are often challenging to conduct. Oren says, “these are a range of applications we have worked on together, for years, and that is why I am so excited that he has won the Nobel Prize”

Now semi-retired, Professor Oren is externally working with Professor Wilson and Hung-po Chao on an APRA-E initiative where they will develop risk management ideas in electricity markets, which is now more uncertain due to the penetration of renewables.

As Oren highlights his journey with Wilson, he credits Wilson for showing him the usage of “optimization as a paradigm for how markets should operate.” The collaboration with Wilson allowed solving of optimization problems by creating a set of rules that, when followed by diverse participants, ensure the optimal outcome. This is crucial because in most large real-world systems, there often isn’t enough information to solve problems centrally using algorithms. In situations like this, where all participants have a piece of the puzzle and the objective of maximization is distributed, approaches of mechanism theory become relevant.

*****

Berkeley IEOR congratulates Robert Wilson and Paul Milgrom for receiving the 2020 Nobel Prize in Economic Sciences.